Staking on Solana lets SOL holders earn rewards while helping secure the network. Whether you choose traditional staking for simplicity or liquid staking for flexibility, this guide explains how to start staking SOL, what to expect, and how to participate in DeFi without sacrificing rewards.

Staking on Solana: Traditional vs Liquid Explained

Learn how to stake SOL on Solana using traditional or liquid staking. Compare methods, platforms, and risks to earn rewards while supporting the network.

Overview

What You'll Learn

- How staking works on Solana’s Proof of Stake (PoS) network

- The differences between traditional and liquid staking

- Pros and cons of each staking method

- How liquid staking tokens (LSTs) unlock DeFi utility

- Trusted platforms for liquid staking on Solana

- Key risks and considerations before staking

Prerequisites

- None. This guide is beginner-friendly and requires no prior experience in crypto or staking.

Understanding the Proof of Stake (PoS) Consensus

Solana uses a Proof of Stake (PoS) system to validate transactions and secure the blockchain. Instead of relying on energy-intensive mining (like Bitcoin), Solana selects validators based on the amount of SOL they have staked—either their own or delegated by users.

By staking SOL, you help:

Confirm and secure transactions

Maintain network performance

Earn rewards for supporting the system

🧠 Think of staking like voting with your tokens—your SOL backs honest validators, and you earn a share of the network’s rewards in return.

Traditional Staking

Traditional staking is the simplest way to participate in Solana’s ecosystem.

How It Works

You delegate your SOL to a validator of your choice using a wallet like Phantom or Solflare. The validator adds your stake to theirs and uses it to help validate transactions. In return, you earn staking rewards.

🔒 Lock-Up Periods

Your SOL remains in your wallet but is locked—you can’t transfer or use it until you choose to unstake, which takes 2–3 days.

Example: If you stake 100 SOL today, you can’t send or use them in DeFi until they’re unstaked and unlocked.

🎯 Benefits and Limitations

Pros:

Low risk, no technical knowledge needed

Consistent, passive rewards (~6–8% APR)

Cons:

Lack of liquidity—funds can’t be used in DeFi

Requires manual unstaking to access tokens

🛠️ Great for long-term holders who want simple passive income.

Liquid Staking

Liquid staking removes the lock-up limitation of traditional staking while still earning rewards.

💡 How It Works

When you stake SOL through a liquid staking protocol, you receive a Liquid Staking Token (LST) in return. This token (e.g. mSOL or bSOL) represents your staked SOL.

You can use this LST in:

DeFi protocols (like lending, farming, DEXs)

Wallets and apps that support liquid staking assets

And while you use it, you still earn staking rewards in the background.

Traditional Staking vs. Liquid Staking

Both traditional and liquid staking methods have their pros and cons:

Traditional Staking

Advantages: Simplicity and a reliable rewards system.

Drawbacks: Lack of liquidity and utility in DeFi platforms.

Liquid Staking

Advantages: Retained liquidity, higher yield potentials, and utility in DeFi.

Drawbacks: Complexity, smart contract risks, and market volatility.

💡 Use traditional staking for simplicity. Choose liquid staking if you want to use your staked SOL in DeFi.

Impact of Liquid Staking on Network Security

Liquid staking does more than boost flexibility—it can improve decentralization.

Staked SOL is often distributed across many validators

This helps prevent centralization of power

It promotes a more resilient and democratic network structure

Protocols like Marinade even encourage delegations to smaller validators, helping strengthen the entire ecosystem.

🧠 Liquid staking supports both individual users and network health.

Liquid Staking Platforms

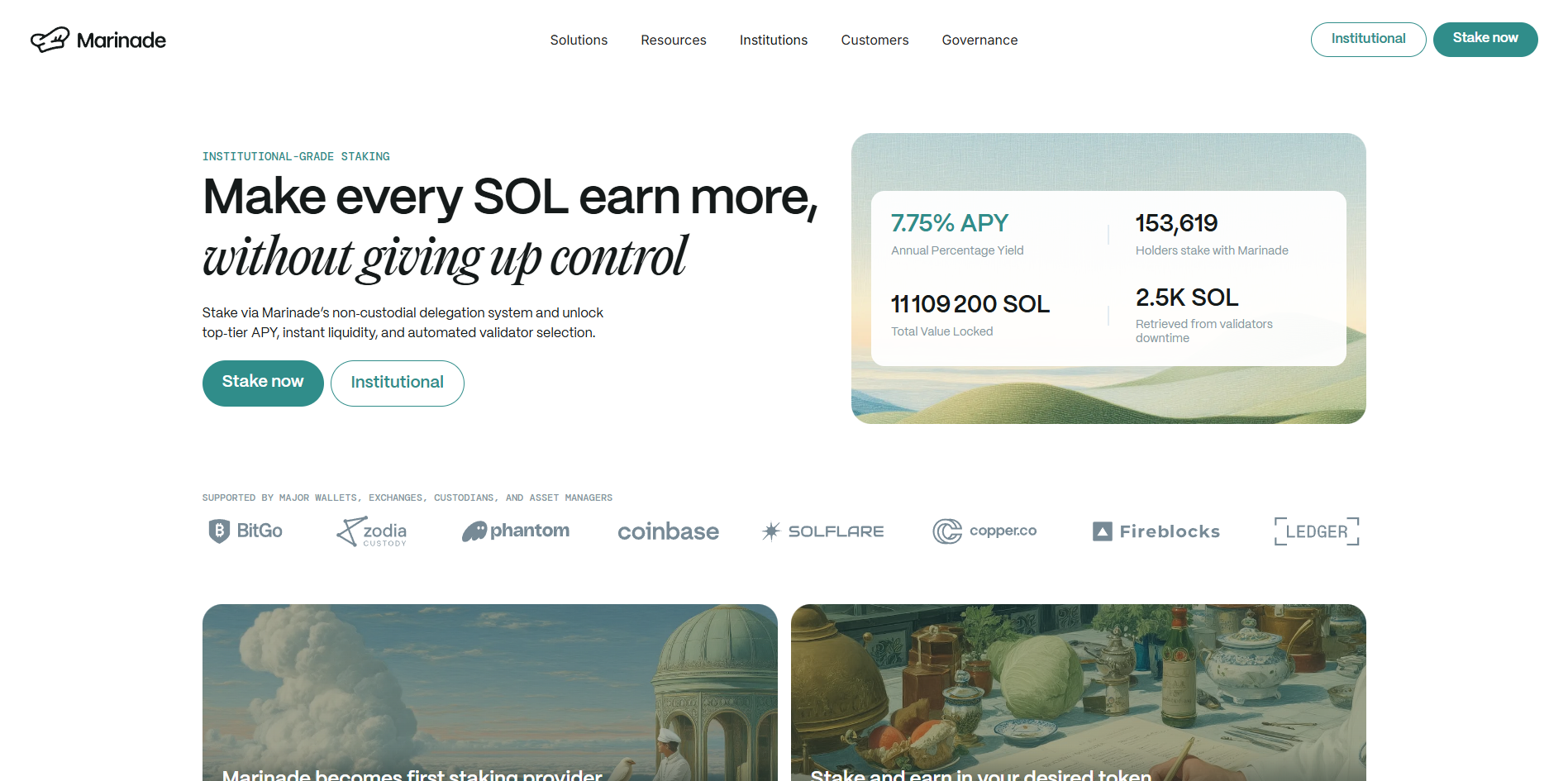

Marinade

Token: mSOL

Features: Open-source, wide DeFi support

Benefit: Automatically delegates to hundreds of validators

Marinade Finance website homepage

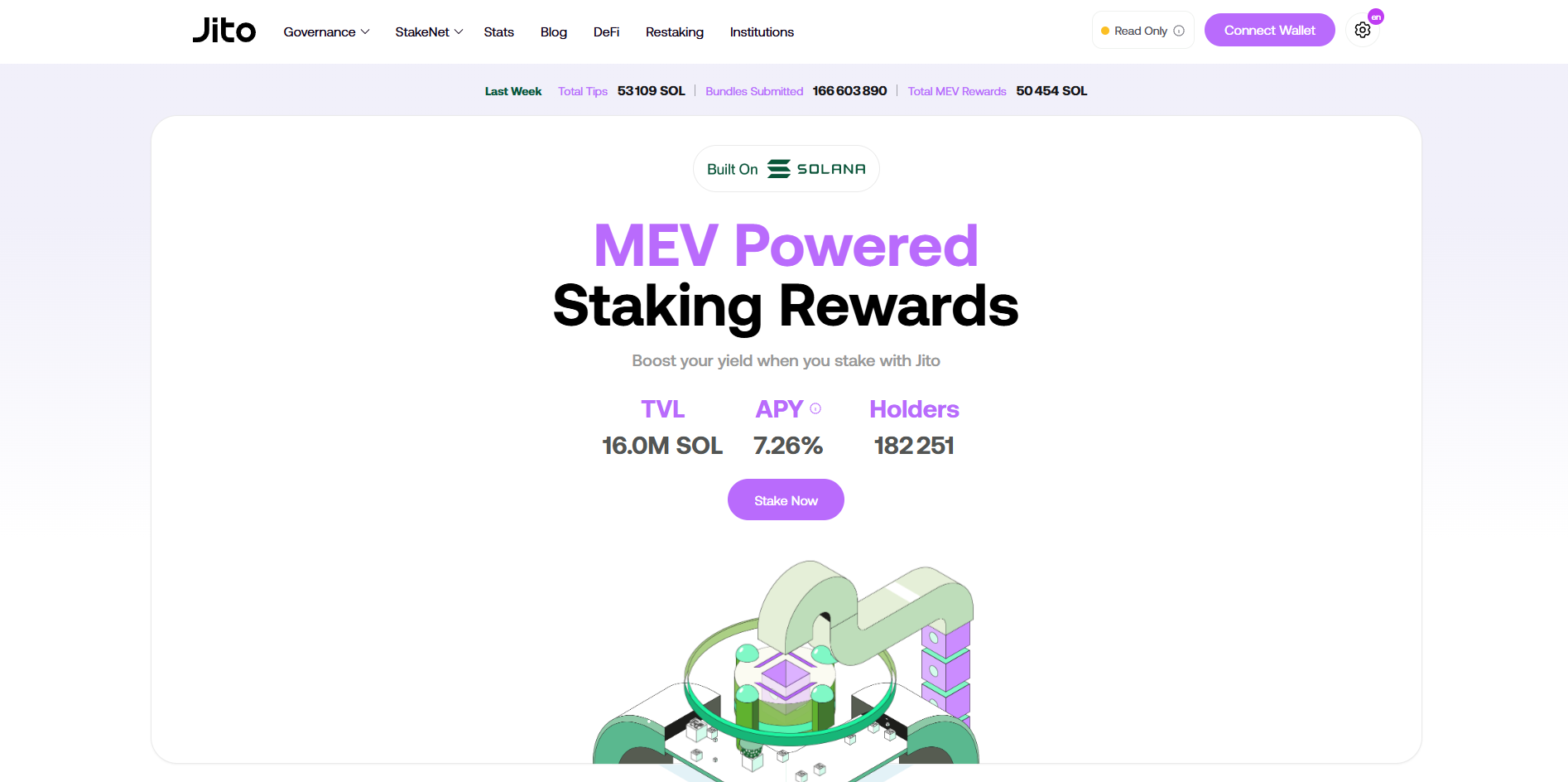

Jito

Token: JitoSOL

Unique Value: Combines staking rewards with MEV rewards (Maximal Extractable Value)

Benefit: Higher potential returns

Jito website homepage

BlazeStake

Token: bSOL

Features: Non-custodial, user-chosen validator set

Benefit: Easy-to-use dashboard and good DeFi integration

BlazeStake Website Homepage

Risks and Considerations in Liquid Staking

🛠 Smart Contract Vulnerabilities

Since liquid staking depends on smart contracts, bugs or exploits could lead to fund losses. Use audited and reputable platforms only.

📉 Volatility and De-pegging

LSTs aim to track the value of SOL, but during high volatility, their price may depeg from 1:1. This affects trading and portfolio value.

💰 Tax Implications

In some regions, receiving LSTs may count as taxable income. Always check with a tax professional before staking large amounts.

🧠 Liquid staking = more flexibility, more responsibility.

Frequently Asked Questions

Common questions about Staking on Solana: Traditional vs Liquid Explained and Solana blockchain

What is staking in simple terms?

Staking means locking your SOL tokens to support the network and earn rewards in return.

Is staking on Solana safe?

Generally, yes—especially with traditional staking. But liquid staking introduces smart contract risks. Choose trusted platforms and understand the terms.

Can I lose access to my staked SOL?

With traditional staking, SOL is locked for a certain period and can’t be used. With liquid staking, your SOL remains usable via LSTs, but there can be depeg risks.

Which is better—traditional or liquid staking?

Traditional staking is simple and stable. Liquid staking offers flexibility and higher potential returns but comes with more complexity and risks.

Can I use my staked SOL in DeFi?

Yes, if you use liquid staking. You'll receive tokens (like mSOL or bSOL) that can be used in lending, trading, or farming while still earning staking rewards.

Is staking taxable?

In many countries, staking rewards—and possibly receiving LSTs—are taxable. Check your local tax regulations.

Wrapping Up

Staking SOL on Solana is a powerful way to earn passive income and strengthen the network. Traditional staking offers a low-risk, hands-off option, while liquid staking provides flexibility and access to DeFi. By understanding how each method works—and the platforms and risks involved—you can choose the staking strategy that fits your goals and risk tolerance.