Crypto bridges on Solana enable seamless transfers of assets between blockchains, unlocking new levels of liquidity, utility, and access to decentralized applications. Whether you're moving tokens from Ethereum or exploring cross-chain DeFi, this guide will help you understand how bridging works, why it matters, and which tools to use.

Bridging on Solana: How to Transfer Cross-Chain Assets

Learn how to use crypto bridges on Solana to move assets across blockchains. Explore bridging tools, benefits, and use cases in DeFi and dApps.

Overview

What You'll Learn

- What crypto bridges are and why they’re essential

- How bridging works on Solana using lock-and-mint systems

- The benefits of bridging: liquidity, utility, and cost savings

- Leading bridge platforms like Wormhole, deBridge, and Allbridge

- Common use cases like accessing dApps and DeFi on Solana

Prerequisites

- None. This guide is beginner-friendly and requires no prior knowledge of bridging or cross-chain protocols.

Understanding Crypto Bridges

Crypto bridges are tools that allow different blockchains to communicate and transfer assets between them. Think of each blockchain as its own country, with its own currency and rules. A bridge acts like an international airport—it lets your digital assets travel from one chain (like Ethereum) to another (like Solana).

These bridges solve a key challenge in crypto: interoperability. They let users break out of isolated ecosystems and access broader opportunities across multiple networks.

Enhancing Liquidity and Utility

Without bridges, assets are stuck on the chain they were created on. Bridging changes that.

By enabling cross-chain transfers, bridges:

Unlock your assets for use in other ecosystems

Allow broader participation in DeFi, NFTs, and games

Increase liquidity across platforms

💡 Example: Bridging USDC from Ethereum to Solana lets you avoid high gas fees and use that USDC in fast, low-cost Solana dApps.

Mechanisms of Bridging

Most bridges on Solana use a lock-and-mint mechanism:

You lock your token (e.g. ETH or USDC) on the source chain

A bridged version of that token is minted on Solana

When you want to go back, the bridged token is burned

Your original token is unlocked on the source chain

This system ensures your assets aren't duplicated—they're simply moved between chains in a secure and traceable way.

Popular Bridge Platforms

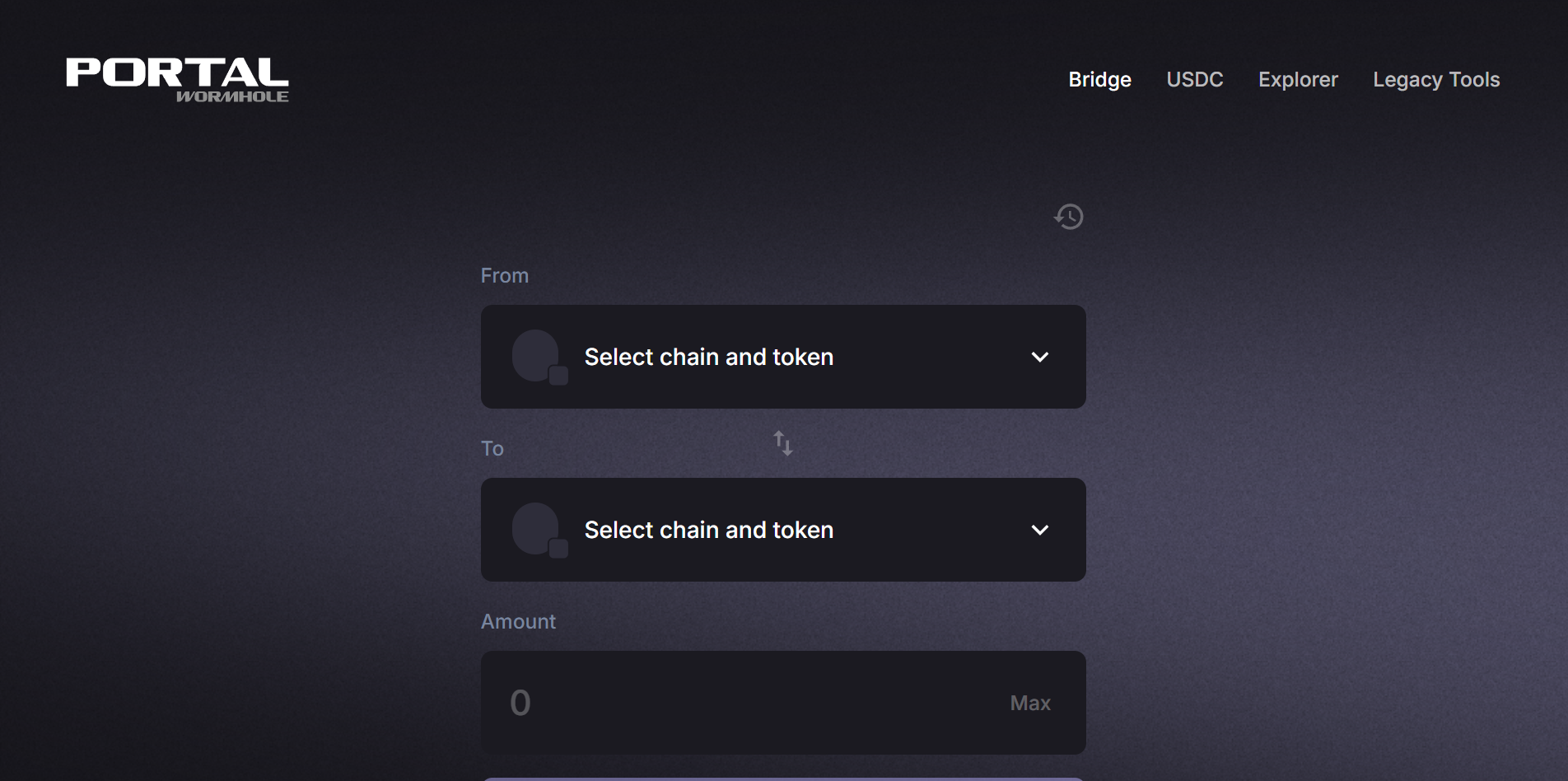

Portal by Wormhole

Fast, efficient, and widely supported

Transfers tokens and NFTs between Solana, Ethereum, BNB Chain, and more

Ideal for DeFi users who want reliable speed and low fees

Portal Wormhole

deBridge

Supports not just transfers, but also cross-chain swaps, lending, and messaging

Designed for dApps and developers to enable seamless cross-chain functionality

A robust option for advanced users and protocols

deBridge

Allbridge

Focuses on ease of use and wide compatibility

Supports many chains with a simple interface for beginners

Great for users bridging stablecoins and common tokens

Allbridge

Benefits of Bridging

💸 1. Enhanced Liquidity

Bridging brings more tokens into the Solana ecosystem, boosting available capital for trading, lending, and DeFi strategies.

🧰 2. Greater Asset Utility

You don’t need to use a centralized exchange. Instead, bridge your assets directly and use them in dApps across multiple networks.

💰 3. Cost Savings

By bypassing exchanges and reducing gas fees, bridging can save both time and money—especially when moving from expensive chains like Ethereum.

Bridging Use Cases

🔓 Access to Solana dApps

Once assets are bridged to Solana, users can explore:

NFT marketplaces like Magic Eden

Trading on platforms like Jupiter

Staking and farming on Solana-native protocols

🌾 DeFi Opportunities

Bridged assets unlock access to:

Liquidity pools

Lending platforms

Yield farming strategies at low cost

🌐 Cross-Chain Expansion

Bridging helps projects grow beyond their original blockchain. Developers can attract more users and liquidity by supporting Solana through bridges.

💡 Example: A DeFi app on Ethereum may launch a Solana version to reduce fees and attract new users—bridging makes this transition smooth.

Frequently Asked Questions

Common questions about Bridging on Solana: How to Transfer Cross-Chain Assets and Solana blockchain

What is a crypto bridge in simple terms?

It’s a tool that lets you move assets from one blockchain to another, like transferring tokens from Ethereum to Solana.

Why would I bridge to Solana?

To take advantage of faster, cheaper transactions and access to Solana-based dApps, NFTs, and DeFi platforms.

Do I lose my original tokens when I bridge?

No. Your tokens are locked on the original chain and you receive an equivalent token on Solana. When you bridge back, the original ones are unlocked.

Can I use bridged tokens in DeFi?

Yes. Once bridged to Solana, you can use tokens in staking, yield farming, trading, and more.

What are the fees for bridging?

Fees vary by bridge and network, but bridging directly often saves money compared to centralized exchanges.

Is bridging safe?

Most major bridges are secure, but risks exist—especially around smart contracts. Always use audited and trusted platforms like Wormhole or deBridge.

Wrapping Up

Bridging brings blockchain ecosystems closer together. With tools like Wormhole, deBridge, and Allbridge, you can move assets to Solana quickly and securely—opening the door to fast DeFi apps, low fees, and NFT markets. By understanding how bridges work, you gain more freedom and flexibility in how you use your crypto across chains.